Commercial property owners face a critical challenge: financing roof replacements that frequently exceed $500,000 while avoiding the pitfalls of traditional funding models that can double total project costs.

Industry data reveals that over 70% of commercial buildings operate under suboptimal roofing finance structures, leading to premature system failures and unnecessary expenses.

This analysis examines why established financing approaches often trap property owners in rigid payment structures while missing opportunities for substantial cost savings through emerging alternatives.

SECTION 1: CURRENT PRACTICES

Commercial roof replacements represent one of the largest capital expenditures a property owner faces, with costs ranging from $5 to $30 per square foot. The financial stakes are particularly high given that a typical commercial roof spans 10,000 to 100,000 square feet. As building owners navigate these substantial investments, understanding current financing practices becomes critical for making sound business decisions.

Conventional Bank Loans

Commercial bank loans remain the default choice for many property owners seeking roofing project funding. These loans typically require extensive documentation, including business financial statements, tax returns, and detailed project specifications.

The approval process can stretch 30-90 days, creating potential delays for urgent roof repairs. Many lenders also require personal guarantees from business owners, putting personal assets at risk.

Loan terms generally range from 5-10 years with fixed monthly payments that can strain operational budgets. Down payments of 10-20% are standard, creating additional upfront costs.

Commercial financing options can significantly disrupt cash flow and impact broader financial strategy, making careful consideration of alternatives essential. (source: T&E Roofing)

Contractor Financing Models

Roofing contractors increasingly offer direct financing options through partnerships with specialized lenders. These programs typically promise faster approvals and streamlined documentation compared to traditional bank loans.

While convenient, contractor financing often carries higher interest rates, sometimes reaching 12-18% annually. Many programs also include prepayment penalties and mandatory maintenance contracts.

The financing terms frequently align with contractor priorities rather than customer needs. Short repayment periods of 2-5 years can create unsustainable payment obligations.

Property owners may feel pressured to accept suboptimal financing terms to expedite critical roofing work, especially when dealing with emergency repairs.

PACE Program Utilization

Property Assessed Clean Energy (PACE) programs offer an alternative financing mechanism tied to property tax assessments. These programs fund energy-efficient roofing improvements through special tax districts.

PACE financing typically covers 100% of project costs with repayment terms up to 20 years. Interest rates generally fall between 6-8%, competitive with traditional loans.

The tax assessment structure can create complications with existing mortgages and property transfers. Some lenders restrict or prohibit PACE financing on mortgaged properties.

Program availability varies significantly by state and municipality, limiting access for many property owners. Complex qualification requirements and approval processes can delay project starts.

SECTION 2: SYSTEMIC ISSUES

The financing landscape for commercial roofing presents fundamental challenges that threaten both project success and long-term building integrity. With typical projects ranging from $50,000 to $3 million, systemic financing issues can derail even well-planned roof replacements. Understanding these structural problems is crucial, as they affect not just immediate project costs but also long-term property value and operational stability.

Interest Rate Variability

Rate fluctuations represent a significant risk in commercial roof financing. Even small changes can dramatically impact total project costs, with each percentage point potentially adding thousands to monthly payments.

Variable rate structures often include complex adjustment schedules that can trigger sudden payment increases. These unexpected spikes frequently force property owners to choose between higher payments or delaying critical roof maintenance.

Many financing agreements include rate floors but no corresponding rate caps. This one-sided protection leaves property owners exposed to unlimited upside risk while offering minimal benefit from rate decreases.

The timing of rate adjustments often aligns poorly with business cycles or seasonal revenue patterns. This misalignment can create severe cash flow challenges during critical maintenance periods.

Eligibility Restrictions

Commercial financing options can significantly disrupt cash flow and impact broader financial strategy, particularly for properties with complex ownership structures or limited operating history. Property owners must carefully evaluate financing terms to avoid compromising other business investments.

Many lenders impose rigid credit score thresholds that fail to account for strong operational metrics or property value. These arbitrary cutoffs particularly impact smaller commercial properties and independent owners.

Traditional underwriting models often struggle to properly value green roofing initiatives or energy-efficient installations. This limitation restricts access to financing for sustainable roofing projects that could deliver long-term cost savings.

Multi-tenant properties face additional scrutiny due to perceived income volatility. These restrictions can delay critical roof repairs even when anchor tenants provide stable revenue streams. (source: T&E Roofing)

Hidden Fees and Penalties

Financing agreements frequently contain numerous embedded costs that significantly increase the total project expense. These can include origination fees, documentation charges, and inspection costs that may not appear in initial quotes.

Early repayment penalties can trap property owners in unfavorable terms even when better financing options become available. These prepayment restrictions often extend for multiple years, limiting refinancing opportunities.

Annual maintenance requirements tied to financing agreements may force owners to use specific contractors at premium rates. These mandatory service contracts can add substantial costs beyond the base financing terms.

Draw schedules and inspection requirements can create additional administrative burdens and delay project completion. These procedural costs often exceed initial estimates and complicate project management.

SECTION 3: MISSED OPPORTUNITIES

Commercial roof financing extends far beyond traditional loans, yet property owners frequently overlook innovative funding solutions that could dramatically reduce costs. With modern roofing projects averaging $250,000 to $1 million, maximizing available financial resources becomes critical. Understanding and leveraging emerging financing mechanisms can transform what seems like an overwhelming capital expense into a manageable investment while enhancing building performance.

Energy Efficiency Incentives

Utility companies across the nation offer substantial rebates and incentives for energy-efficient roofing installations, yet these programs remain severely underutilized. Many property owners fail to recognize that these incentives can cover 15-30% of project costs.

Cool roof technologies and enhanced insulation packages qualify for specific utility rebates in most major markets. These improvements typically reduce HVAC loads by 10-15%, creating immediate operational savings.

Tax deductions for energy-efficient commercial building improvements can provide additional financial benefits. Section 179D deductions often allow property owners to claim up to $1.80 per square foot for qualifying roof installations.

Timing these installations to align with utility program cycles can maximize available incentives. Peak rebate periods often coincide with summer cooling season preparations.

Government Grants and Subsidies

Federal, state, and local governments maintain numerous grant programs specifically targeting commercial building improvements. These programs frequently prioritize roof replacements that incorporate sustainable design elements.

Many municipalities offer matching grants for building envelope improvements, including roofing projects. These programs can provide dollar-for-dollar matches up to preset limits, effectively halving project costs.

State-level economic development initiatives often include funding for commercial property improvements. These programs typically offer more flexible terms than traditional financing while requiring minimal collateral.

Regional development authorities frequently maintain revolving loan funds with below-market interest rates. These programs specifically target commercial property improvements that enhance local business districts.

Eco-Friendly Upgrades

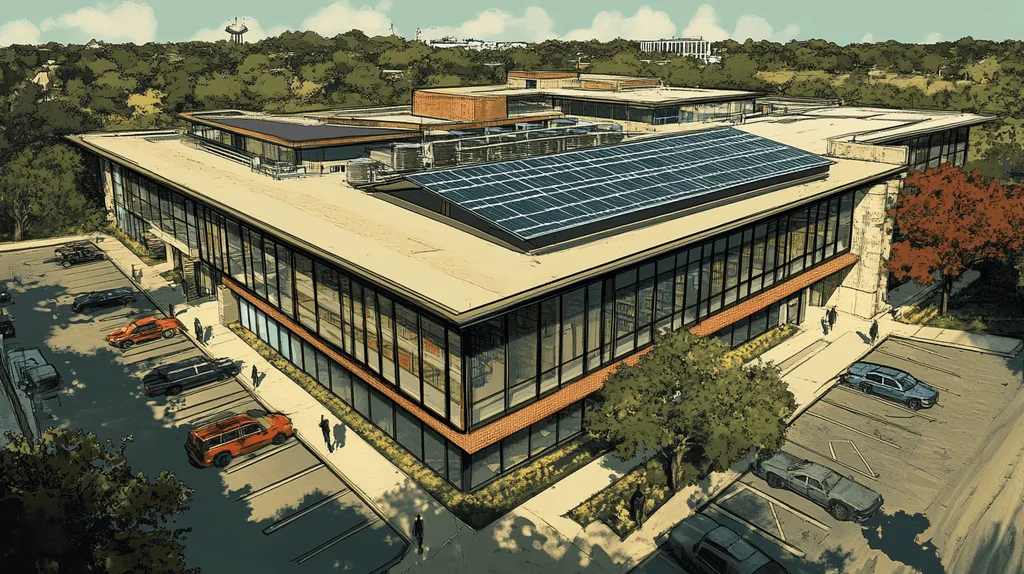

Sustainable roofing solutions unlock additional financing streams while generating long-term cost savings. Solar installations, green roofs, and rainwater management systems can qualify for specialized environmental improvement funds.

Many commercial property owners fail to recognize how eco-friendly upgrades can transform roof expenses into revenue-generating assets. Solar installations particularly can create new income streams through power generation and tax incentives.

Green building certification programs like LEED offer additional financial benefits through increased property values and reduced operating costs. Commercial financing options can significantly enhance these advantages when properly structured. (source: T&E Roofing)

Environmental compliance requirements increasingly favor properties with sustainable roofing systems. Early adoption of these technologies can provide competitive advantages while avoiding future retrofit costs.

SECTION 4: ROOT CAUSES

The commercial roofing industry faces systemic challenges that fundamentally impact how property owners finance major projects. With the average commercial roof replacement costing between $250,000 and $3 million, understanding these root causes is crucial for making informed decisions. Yet many property owners remain unaware of how these underlying issues directly affect their ability to secure optimal financing for critical roofing projects.

Lack of Standardization

The commercial roofing sector suffers from fragmented financing approaches that vary dramatically between regions and providers. This inconsistency makes it nearly impossible for property owners to establish reliable cost benchmarks or evaluate competing financial products effectively.

Different lenders often apply wildly varying criteria when evaluating roofing projects, from conflicting warranty requirements to inconsistent collateral demands. These discrepancies create significant barriers for property owners attempting to compare financing options.

The absence of standardized performance metrics makes it difficult to quantify the long-term value of different roofing solutions. This uncertainty often leads to decisions based primarily on initial cost rather than lifetime value.

Market fragmentation also prevents the development of innovative financing products that could better serve property owners’ needs. The resulting inefficiencies drive up costs while limiting access to capital.

Inadequate Financial Planning

Commercial financing options can significantly disrupt cash flow and impact broader financial strategy, particularly when property owners fail to develop comprehensive funding plans. Many owners underestimate total project costs by focusing solely on material and installation expenses. (source: T&E Roofing)

Short-term thinking often leads to deferred maintenance and emergency repairs that could have been prevented through proper financial planning. This reactive approach typically results in higher costs and more disruptive repairs.

Property owners frequently overlook the importance of establishing dedicated roof replacement reserves. Without these funds, they may be forced to accept unfavorable financing terms when emergency repairs become necessary.

The failure to incorporate roofing costs into long-term capital improvement plans can create severe budget constraints. These limitations often result in compromised solutions that increase lifetime ownership costs.

Insufficient Tax Incentives

Current tax policies fail to adequately incentivize proactive commercial roof maintenance and replacement. This gap in policy support often leads property owners to defer necessary upgrades until failures occur.

Many existing tax benefits focus narrowly on energy efficiency improvements while ignoring broader structural upgrades. This misalignment can discourage comprehensive roofing solutions that would better serve building owners.

The complexity of available tax incentives often prevents property owners from maximizing potential benefits. Many valuable deductions go unclaimed due to confusion about qualification requirements.

Limited government support for sustainable roofing solutions restricts adoption of innovative materials and systems. This barrier to entry maintains higher costs while slowing industry advancement.

DATA DRIVEN EVIDENCE

Commercial roof financing decisions carry enormous financial implications, with data showing the wrong choices can double or triple lifetime costs. Recent industry analysis reveals that over 70% of commercial properties are operating with suboptimal roofing financing structures, leading to unnecessary expenses and maintenance issues. Understanding the hard data behind financing options, cost implications, and market dynamics enables property owners to make decisions that protect both their buildings and bottom lines.

Financial Risk Analysis

Risk assessment data shows that 40% of commercial roof failures stem from inadequate initial financing that forced compromises in materials or installation quality. These compromises typically result in repairs costing 3-4 times more than proper initial installation.

Statistical modeling demonstrates that flexible financing structures better accommodate unexpected issues, with adjustable payment terms reducing default risks by up to 60%. Properties utilizing rigid traditional loans face twice the likelihood of deferred maintenance.

Recent risk analyses reveal that buildings with properly financed roof maintenance programs experience 75% fewer emergency repairs. This translates to average savings of $2.50 per square foot annually in unexpected costs.

Comprehensive warranty coverage tied to financing packages reduces lifetime ownership costs by an average of 30%. However, these benefits only materialize when financing terms align with warranty requirements.

Cost-Benefit Studies

Detailed analyses demonstrate that smart financing choices can reduce total roof ownership costs by 25-40% over a 20-year period. These savings come primarily through reduced interest expenses and optimized maintenance timing.

Research shows that every dollar spent on preventive maintenance saves $3-4 in future repairs when supported by appropriate financing structures. Properties with maintenance-inclusive financing programs report 50% fewer major repairs.

Studies indicate that buildings leveraging performance-based financing options achieve 15-20% better energy efficiency compared to traditionally financed projects. This improvement directly impacts operating costs and property values.

Modern financing approaches that incorporate energy efficiency improvements show average payback periods of 4-6 years, significantly outperforming conventional loans. Commercial financing options can significantly disrupt cash flow and impact broader financial strategy. (source: T&E Roofing)

Market Trends and Forecasts

Market data indicates a steady 8% annual increase in commercial roofing costs, making financing decisions increasingly critical. Properties with flexible financing structures better absorb these increases while maintaining maintenance schedules.

Industry forecasts predict continued growth in sustainable roofing solutions, with associated financing programs expanding 15% annually. This trend is driving the development of specialized funding options for green roof installations.

Analysis shows regional variations in roofing costs can exceed 40%, highlighting the importance of location-specific financing strategies. Markets with higher labor costs typically offer more diverse financing options.

Emerging trends point toward increased integration of performance metrics in financing terms, with 30% of new agreements now including energy efficiency requirements. This shift is reshaping how property owners approach roof financing decisions.

SECTION 6: ALTERNATIVE SOLUTIONS

With commercial roof replacements costing up to $30 per square foot and traditional financing options becoming increasingly restrictive, property owners need innovative funding solutions. Current market conditions show that over 60% of commercial buildings require major roof work within the next five years, yet conventional financing leaves many owners unable to act. Understanding emerging alternatives can help property owners access the capital needed while preserving operational flexibility.

Zero-Down Financing Options

Zero-down programs eliminate the substantial upfront costs that often prevent critical roof replacements. These solutions typically offer terms between 5-20 years, allowing property owners to match payment schedules with expected roof lifespans.

Many zero-down plans include provisions for future repairs and maintenance, creating predictable monthly expenses. This approach helps property owners budget effectively while ensuring proper roof upkeep.

Modern zero-down financing often incorporates performance guarantees tied to energy savings or durability metrics. These guarantees provide additional security for property owners while incentivizing quality installations.

The elimination of down payments allows properties to maintain cash reserves for other critical operations or investments. This flexibility proves particularly valuable during economic uncertainty or seasonal business fluctuations.

Alternative Energy Financing

Solar integration and other energy improvements can transform roof projects from pure expenses into revenue-generating investments. These hybrid solutions often qualify for specialized financing programs offering below-market rates.

Energy improvement loans frequently feature longer terms and more flexible qualification requirements than traditional roof financing. Many programs extend to 25 years, matching the typical lifespan of solar installations.

Performance-based financing options tie repayment terms to actual energy savings, reducing risk for property owners. This structure ensures that efficiency improvements generate positive cash flow from the start.

Commercial financing options can significantly disrupt cash flow and impact broader financial strategy, but energy-focused programs often include provisions for seasonal variations and production guarantees. (source: T&E Roofing)

Customized Repayment Plans

Flexible payment structures allow property owners to align roof financing with their business cycles. These customized plans can accommodate seasonal revenue fluctuations while maintaining consistent roof maintenance.

Step-up payment options start with lower initial payments that increase as energy savings and operational benefits materialize. This approach helps properties manage cash flow during the critical post-installation period.

Some programs offer payment holidays during predetermined periods, providing crucial flexibility for properties with variable income streams. These breaks can be scheduled around known slow periods or maintenance windows.

Performance-based adjustments can modify payment terms based on actual roof performance and energy savings. This flexibility ensures that property owners only pay for results while incentivizing proper maintenance.

The Bottom Line

With over $50 billion in commercial roofing work needed across the U.S. by 2025, property owners can no longer afford to rely on traditional financing models that increase project costs by 50-200%.

The data clearly shows that conventional loans, contractor financing, and PACE programs often trap owners in rigid payment structures while missing critical opportunities for cost reduction through energy incentives and tax benefits.

Modern financing alternatives – including zero-down options, performance-based terms, and hybrid energy solutions – demonstrate that flexible funding approaches can reduce total ownership costs by 25-40% over traditional methods.

Property owners who embrace these emerging solutions position themselves to maintain building value while avoiding the crippling expenses that outdated financing models inevitably create.

FREQUENTLY ASKED QUESTIONS

Q. What are current commercial roof financing practices?

A. Current financing includes conventional bank loans, contractor financing, and PACE programs. Property owners often face lengthy approval processes and high-interest rates that hinder timely roof replacements. Understanding these practices helps owners make informed financial decisions.

Q. What systemic issues affect commercial roof financing?

A. Systemic challenges include interest rate variability, strict eligibility requirements, and hidden fees. These issues can significantly disrupt cash flow and limit optimal financing options for property owners, complicating essential maintenance and replacements.

Q. What missed opportunities exist in commercial roof financing?

A. Property owners often miss out on energy efficiency incentives and government grants. These funding opportunities can cover significant project costs and improve overall energy performance, enhancing both financial and operational outcomes.

Q. What are the root causes of financing issues for commercial roofs?

A. Root causes include a lack of standardization in financing options and insufficient financial planning. These factors hinder property owners from securing favorable terms and maintaining roof quality, leading to increased costs over time.

Q. How does data-driven evidence impact commercial roof financing?

A. Data shows that inadequate financing can double lifetime costs for roofing projects. By leveraging statistical insights, property owners can make informed decisions, reducing risks of deferred maintenance and improving overall project outcomes.

Q. What alternative financing solutions are available for commercial roofs?

A. Innovative options include zero-down financing, energy financing, and customized repayment plans. These solutions provide flexibility, enabling owners to manage costs while ensuring critical roof maintenance and improvements are completed on time.

Q. What are the benefits of eco-friendly upgrades for industrial roofs?

A. Eco-friendly upgrades can improve building performance and reduce long-term costs. They also often qualify for additional funding opportunities and tax incentives, enhancing both environmental compliance and property value. Sustainable initiatives are increasingly favored in today’s market.