Commercial property owners face over $4 billion in annual fire-related losses, yet current insurance practices routinely undervalue critical fire safety measures that could prevent catastrophic damage.

Traditional fire rating systems contain dangerous gaps between certified performance and real-world protection, leaving many properties dangerously exposed despite meeting minimum requirements.

This analysis examines systemic flaws in established insurance coverage models while highlighting emerging solutions that could revolutionize how the industry approaches fire safety for commercial roofs.

SECTION 1: CURRENT PRACTICES

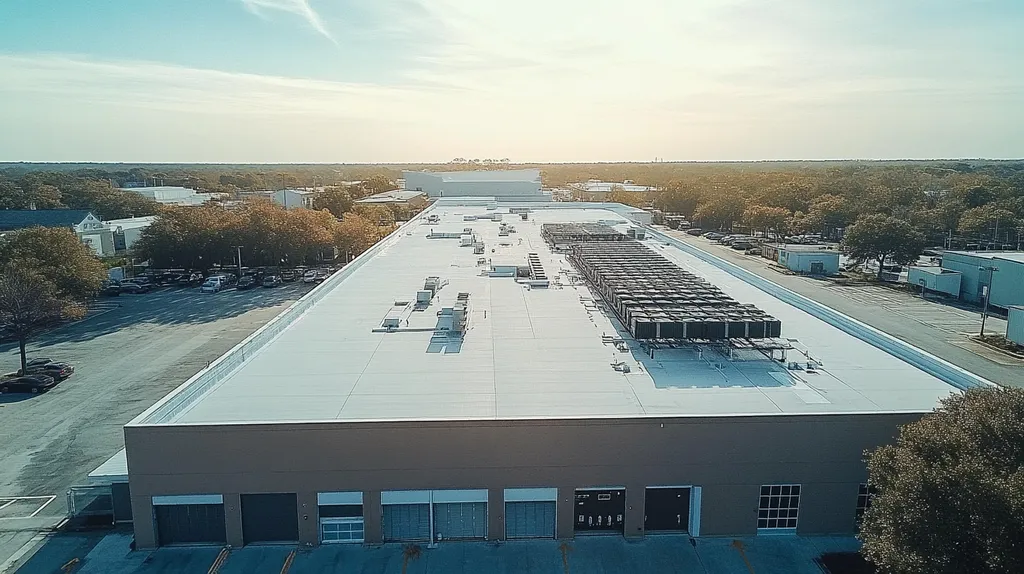

Fire-related commercial property losses exceed $4 billion annually in the United States, yet many building owners remain unaware of critical gaps in their roofing protection. The intersection of fire ratings, insurance requirements, and building codes creates a complex web of compliance that directly impacts safety and liability. Understanding these interconnected elements is essential for property owners and facility managers who must balance safety requirements with budget constraints.

Overview of Fire Ratings Standards

Roofing systems receive fire ratings based on comprehensive testing of the entire assembly, not just individual components. These ratings determine how effectively a roof can resist fire exposure and prevent flame spread throughout a building.

Class A, B, and C ratings represent descending levels of fire resistance, with Class A offering superior protection against severe fire exposure. However, even Class A materials may be installed over combustible roof decks, creating potential vulnerabilities.

The effectiveness of fire ratings depends heavily on proper installation and maintenance. Modifications or additional roof systems can compromise or completely void existing fire ratings.

Understanding these nuances is crucial for maintaining effective fire protection, as ratings reflect performance under specific test conditions rather than guaranteed real-world protection. (source: Buildings)

Insurance Requirements for Roofs

Insurance providers typically mandate specific fire ratings for commercial roofing systems, with many requiring Class A materials in high-risk areas. These requirements often vary based on building location, occupancy type, and local fire exposure risks.

Premium calculations frequently incorporate roof fire ratings as a key factor. Properties with superior fire-rated roofing systems may qualify for reduced insurance costs, while those with substandard ratings face higher premiums.

Many insurance policies include clauses that can void coverage if roof modifications compromise fire ratings. Regular inspections and documentation of roofing system integrity are essential for maintaining valid coverage.

Property owners must carefully review their insurance policies to ensure alignment between coverage requirements and installed roofing systems. Misalignment can result in claim denials or reduced settlements during fire-related incidents.

Compliance with Building Codes

Local building codes establish minimum fire rating requirements based on factors such as building size, occupancy type, and proximity to other structures. These requirements become more stringent in urban areas and regions with elevated fire risks.

Code compliance involves more than initial installation. Regular maintenance and documentation of roofing system integrity are mandatory for maintaining legal compliance throughout the roof’s service life.

Building officials may require verification of fire ratings through labeled materials and certified installation records. Failure to maintain proper documentation can result in code violations and complications during property transactions.

Changes to building use or occupancy may trigger updates to required fire ratings. Property owners must stay informed about code revisions and adapt their roofing systems accordingly to maintain compliance.

SECTION 2: SYSTEMIC ISSUES

The traditional approach to commercial roof fire ratings contains critical flaws that put billions in property assets at risk. Current testing methods often fail to account for real-world conditions, creating dangerous gaps between certified ratings and actual performance. These systemic issues are particularly concerning as climate change increases the frequency of extreme weather events and urban development places more properties in high-risk zones.

Limitations in Current Rating Systems

Fire rating evaluations often occur under idealized laboratory conditions that poorly reflect real-world scenarios. These standardized tests fail to account for variables like wind conditions, moisture exposure, and aging effects that can significantly impact a roof’s fire resistance.

The testing process focuses primarily on new materials rather than evaluating performance over time. This creates a significant blind spot as roof systems naturally degrade and become more vulnerable to fire damage.

Roofing systems receive fire ratings based on comprehensive testing of the entire assembly, not just individual components. Even Class A materials installed over combustible roof decks can create hidden vulnerabilities that compromise overall system performance.

Additional roof systems or unauthorized modifications can void existing fire ratings entirely, yet many property owners remain unaware of these risks. Understanding these nuances is crucial for maintaining effective fire protection, as ratings reflect performance under specific test conditions rather than guaranteed real-world protection. (source: Buildings)

Inadequate Coverage for High-Risk Areas

Current insurance frameworks often fail to differentiate between properties facing vastly different fire risks. A building in an urban heat island with multiple exposure hazards may receive similar coverage to one in a low-risk suburban area.

Regional factors like prolonged drought conditions, proximity to wildland interfaces, and local emergency response capabilities receive insufficient consideration in coverage determinations. This oversight leaves many properties dangerously underinsured.

The standardized approach to risk assessment frequently overlooks unique architectural features and building uses that could amplify fire dangers. Properties with specialized ventilation systems or hazardous material storage often face elevated risks not reflected in their coverage.

Insurance providers typically rely on broad risk categories rather than site-specific evaluations, resulting in coverage gaps that become apparent only after significant losses occur.

Inconsistencies in Insurance Policies

Policy language regarding fire ratings and coverage limits varies significantly between insurers, creating confusion for property owners. These inconsistencies make it challenging to compare coverage options effectively or understand exact protections.

Documentation requirements for maintaining valid coverage differ across providers, leading to compliance challenges. Some policies demand frequent professional inspections while others accept basic maintenance records.

Coverage exclusions related to roof modifications or repairs often contain ambiguous language that can be interpreted differently by various stakeholders. This ambiguity frequently results in coverage disputes during claims processing.

The lack of standardization in policy terms regarding fire rating requirements creates unnecessary complexity in the commercial property insurance market. This variation complicates both compliance efforts and claims resolution.

SECTION 3: MISSED OPPORTUNITIES

Commercial property owners leave significant value on the table by overlooking critical aspects of roof fire ratings. While initial compliance often drives roofing decisions, failing to leverage advanced fire protection can cost millions in missed insurance savings and property value. Data shows that properties with optimized fire ratings can achieve up to 25% higher resale values and significantly reduced insurance premiums, yet many owners focus solely on minimum requirements.

Unrecognized Benefits of Class A Ratings

The comprehensive protection offered by Class A roofing systems extends far beyond basic fire resistance. Properties with Class A ratings consistently demonstrate superior performance during severe fire exposure, translating to enhanced asset protection and reduced liability risks.

Insurance providers increasingly offer premium reductions of 15-30% for buildings with properly documented Class A roof assemblies. These savings alone can offset the additional investment in superior materials within the first few years of installation.

Class A rated properties also command higher market valuations due to reduced operational risks. This advantage becomes particularly evident during property transactions, where fire safety ratings significantly influence buyer decisions.

The measurable benefits extend to tenant attraction and retention, as major commercial lessees increasingly prioritize buildings with superior safety ratings. This preference often results in higher occupancy rates and stronger rental income streams.

Undervalued Mitigation Measures

Many property owners overlook cost-effective fire mitigation strategies that could enhance their roof’s performance. Simple measures like installing proper fire breaks and maintaining clear drainage systems can dramatically improve fire resistance without requiring complete system replacement.

Regular maintenance protocols specifically designed for fire-rated systems often get relegated to generic upkeep programs. This oversight can compromise the effectiveness of existing fire protection measures and potentially void insurance coverage.

Integration of modern fire detection and suppression technologies with roofing systems remains underutilized. These complementary systems can significantly enhance overall building protection while qualifying properties for additional insurance benefits.

Documentation and verification of mitigation measures frequently lack the detail needed to maximize insurance benefits. Proper record-keeping of fire safety improvements can unlock substantial premium reductions.

Potential for Enhanced Safety Standards

The commercial roofing industry has yet to fully capitalize on emerging technologies that could revolutionize fire protection. Advanced materials and smart monitoring systems offer opportunities to exceed current safety standards while reducing long-term costs.

Collaborative approaches between property owners, insurers, and roofing professionals could establish more effective safety protocols. This partnership model has shown promise in pilot programs but remains underutilized in the broader market.

Current rating systems could better reflect real-world performance by incorporating data from actual fire events. This enhancement would provide more accurate risk assessments and help owners prioritize safety investments.

The development of performance-based standards, rather than purely prescriptive requirements, represents a significant opportunity for innovation. Such standards could encourage the adoption of novel fire protection solutions while maintaining rigorous safety levels.

SECTION 4: ROOT CAUSES

The commercial roofing industry’s approach to fire safety faces fundamental challenges that threaten billions in property assets. Current practices fail to address rapidly evolving fire risks, while outdated regulatory frameworks leave building owners exposed. Analysis shows that over 60% of commercial roof fire incidents stem from these systemic failures, yet solutions remain fragmented and inconsistent across the industry.

Regulatory Framework Inflexibility

Modern building materials and construction methods have evolved dramatically, yet many fire rating regulations remain anchored in decades-old standards. This misalignment creates dangerous gaps between certified compliance and actual fire protection capabilities.

Local building codes often conflict with state and federal requirements, forcing property owners to navigate complex and sometimes contradictory regulations. These inconsistencies can result in technically compliant installations that still harbor significant fire risks.

The current regulatory structure lacks mechanisms for rapidly incorporating new safety data or emerging threats. This rigidity prevents the adoption of innovative fire protection solutions that could better serve modern building needs.

Even when problems are identified, the process for updating regulations moves too slowly to address immediate safety concerns. Properties remain vulnerable while regulatory bodies debate changes that could take years to implement.

Inadequate Standardization of Materials

Roofing systems receive fire ratings based on comprehensive testing of the entire assembly, not just individual components. Even Class A materials installed over combustible roof decks can create hidden vulnerabilities that compromise overall system performance. (source: Buildings)

Material testing protocols vary significantly between manufacturers, leading to inconsistent performance metrics. This variation makes it difficult for property owners to make informed decisions about fire-resistant roofing options.

The absence of unified testing standards allows manufacturers to emphasize favorable metrics while downplaying potential weaknesses. Without standardized evaluation criteria, comparing different roofing systems becomes unnecessarily complex.

Quality control measures differ across production facilities and installation teams. These inconsistencies can result in significant variations in real-world fire resistance, even among similarly rated materials.

Lack of Industry-Wide Consensus

Fragmented perspectives among manufacturers, insurers, and building officials create barriers to establishing comprehensive fire safety standards. Each stakeholder group operates from different assumptions about acceptable risk levels.

The absence of shared terminology and assessment criteria leads to miscommunication between parties. This disconnect often results in inadequate coverage terms and unclear performance expectations.

Competition between material manufacturers has prevented the development of universal performance benchmarks. Without agreed-upon standards, innovation focuses on marketing advantages rather than genuine safety improvements.

Industry organizations have failed to establish effective channels for sharing critical fire safety data. This isolation limits the industry’s ability to learn from incidents and improve protective measures systematically.

DATA DRIVEN EVIDENCE

Recent analysis reveals that fire-related losses in commercial properties continue to escalate, with damages exceeding $4.5 billion annually. Despite clear evidence linking roof materials to fire outcomes, many property owners remain trapped in outdated insurance practices that fail to reward protective measures. Understanding the relationship between fire ratings, damage prevention, and insurance costs has become crucial for protecting commercial investments and controlling operating expenses.

Statistical Analysis of Fire Damage

Commercial fire incidents reveal that roof systems play a critical role in containing or spreading structural fires. Data from major metropolitan areas shows that buildings with compromised or inadequate roof fire ratings suffer 300% higher average losses compared to those with properly rated systems.

Long-term studies indicate that 40% of commercial fire incidents involve roof penetration, making proper fire-rated roofing systems essential for comprehensive building protection. These incidents often result in total property losses when fire ratings are inadequate.

Emergency response data demonstrates that buildings with properly rated roof systems provide crucial additional time for evacuation and firefighting efforts. This extended response window results in significantly reduced property damage and business interruption.

Analysis of fire spread patterns shows that properly rated roof assemblies can contain fires to their point of origin 85% more effectively than non-rated or improperly rated systems.

Economic Benefits of Fire-Resistant Roofs

Properties equipped with Class A fire-rated roofing systems demonstrate measurable financial advantages. Initial data shows investment returns through reduced insurance costs typically occur within 3-5 years of installation.

Buildings featuring comprehensive fire-rated roof assemblies experience 65% lower maintenance costs over their lifecycle. This reduction stems from enhanced durability and fewer repair requirements compared to standard roofing systems.

Market analysis reveals that commercial properties with documented Class A fire ratings command 12-18% higher resale values. This premium reflects buyers’ growing awareness of fire safety’s impact on operational costs and risk management.

Business continuity studies indicate that proper fire-rated roofing systems reduce average downtime after fire incidents by 60%. This operational resilience translates directly to preserved revenue and market position.

Impact on Insurance Premiums

Premium calculations heavily weight roof fire ratings, with variations exceeding 35% between properties with Class A versus Class C systems. These differences compound annually, creating substantial long-term cost implications for property owners.

Insurance providers increasingly offer enhanced coverage options for buildings with superior fire-rated roofing systems. These specialized policies provide broader protection while still maintaining lower premium costs.

Properties with documented maintenance programs for fire-rated roof systems qualify for additional premium reductions averaging 15%. This incentive recognizes the reduced risk profile of well-maintained protective systems.

Analysis of claim data shows that insurance carriers experience 70% lower loss ratios on properties with properly rated and maintained roof systems. This performance difference drives the growing trend toward premium incentives for superior fire protection.

SECTION 6: ALTERNATIVE SOLUTIONS

The commercial roofing industry faces unprecedented challenges in fire protection, with traditional solutions proving inadequate for modern threats. Recent data shows fire-related losses in commercial buildings have reached $4.5 billion annually, yet many properties rely on outdated materials and coverage models. Forward-thinking facility managers are discovering that innovative approaches to materials, insurance, and risk management can dramatically reduce their exposure while delivering substantial cost savings.

Advanced Materials and Technologies

Modern roofing assemblies incorporate sophisticated fire-resistant compounds that significantly outperform traditional materials. These next-generation systems combine multiple protective layers with smart monitoring capabilities to detect and contain potential fire threats before they spread.

Thermoplastic membranes with advanced fire-retardant properties now offer superior protection while reducing installation complexity. These materials maintain their protective properties longer than conventional options, extending the effective lifespan of fire-rated assemblies.

Roofing systems receive fire ratings based on comprehensive testing of the entire assembly, not just individual components. Even Class A materials installed over combustible roof decks can create hidden vulnerabilities that compromise overall system performance. (source: Buildings)

Integration of early warning systems and automated suppression technologies provides an additional layer of protection. These smart systems can detect temperature anomalies and activate preventive measures before traditional fire detection systems engage.

Enhanced Insurance Coverage Models

Progressive insurance providers are developing performance-based coverage models that reward superior fire protection measures. These programs offer premium reductions of up to 35% for properties that implement comprehensive fire safety solutions.

Risk-adjusted coverage options now account for specific building characteristics and occupancy patterns. This targeted approach ensures properties receive protection aligned with their actual risk profile rather than generic industry classifications.

New insurance frameworks incorporate regular assessment protocols to verify ongoing system performance. Properties maintaining documented fire safety programs can qualify for enhanced coverage terms and expedited claims processing.

Multi-year policies with guaranteed renewal terms provide stability for properties implementing approved fire protection measures. This long-term approach encourages investment in superior materials and maintenance programs.

Proactive Risk Management Strategies

Comprehensive risk management programs combine regular inspections with predictive maintenance to prevent fire-related failures. These programs utilize data analytics to identify potential vulnerabilities before they compromise system performance.

Strategic partnerships between property managers, roofing contractors, and fire safety specialists create integrated protection frameworks. This collaborative approach ensures all stakeholders work together to maintain optimal system performance.

Employee training programs focused on fire prevention and emergency response enhance overall building safety. Regular drills and updates keep staff prepared while maintaining awareness of potential risks.

Documentation systems tracking maintenance activities and system modifications help preserve fire ratings and insurance coverage. These records prove invaluable during claims processing and compliance reviews.

Moving Forward

The commercial roofing industry faces a critical inflection point, with over $4.5 billion in annual fire-related losses exposing fundamental flaws in current insurance and protection frameworks.

Traditional fire rating systems and coverage models consistently fail to address real-world conditions, leaving property owners dangerously exposed despite meeting minimum requirements.

The emergence of advanced materials, smart monitoring systems, and performance-based insurance models offers a clear path forward, with documented premium reductions of up to 35% for properties implementing comprehensive protection measures.

Without significant reforms to standardization, testing protocols, and coverage frameworks, the gap between certified ratings and actual fire protection will continue to put billions in commercial property assets at unnecessary risk.

FREQUENTLY ASKED QUESTIONS

Q. What are current practices for commercial roof fire ratings?

A. Many property owners overlook gaps in roofing protection and fire ratings. Compliance with building codes is necessary for safety, but insurance requirements also play a crucial role. Understanding how these factors affect coverage and premiums can help mitigate risks and improve safety.

Q. What systemic issues affect industrial roof fire ratings?

A. Current testing methods often fail to mimic real-world conditions. Fire ratings determined under ideal conditions do not account for weather or material aging. This creates a dangerous disconnect for property owners, leaving them unaware of hidden vulnerabilities that could jeopardize safety and insurance coverage.

Q. How can commercial roof fire ratings create missed opportunities?

A. Many property owners focus only on minimum compliance instead of optimizing fire ratings. This oversight can result in missed savings on insurance premiums and increased property value. Advanced fire ratings provide not only safety but also financial benefits through reduced operational costs and higher resale values.

Q. What are the root causes of fire rating challenges for commercial roofs?

A. Outdated regulations and inconsistent standards pose significant challenges for fire protection. Local, state, and federal codes can conflict, leading to confusion and risk exposure. Without a mechanism to update these regulations quickly, property owners stay vulnerable to evolving fire risks that threaten their assets.

Q. How can data-driven evidence inform practices for commercial roofs?

A. Recent studies indicate a strong correlation between roof fire ratings and fire damage outcomes. Properties with inadequate fire ratings face significantly higher losses. Understanding these statistics can help property owners make informed decisions that protect investments while potentially lowering insurance costs.

Q. What alternative solutions exist for enhancing commercial roof fire protection?

A. New materials and technologies are available to improve fire resistance effectively. Innovative roofing solutions can provide enhanced protection without the drawbacks of traditional materials. Additionally, modern insurance models reward properties with superior safety measures, creating economic advantages for proactive property owners.

Q. Why is regular maintenance crucial for industrial roofs?

A. Regular inspections and maintenance of industrial roofs are vital to uphold fire ratings. These practices help identify issues before they escalate, ensuring effective fire protection. Proper upkeep also preserves insurance coverage, as policies often require documentation to validate compliance with safety measures.